Your credit score has never been more important than today; with an inflation rate that continues to rise, everything we need to survive has become very expensive.

You’re wondering, what does my credit score have to do with this?

Well, the higher your credit score is, the cheaper you can borrow money, get insurance, and even purchase a new phone.

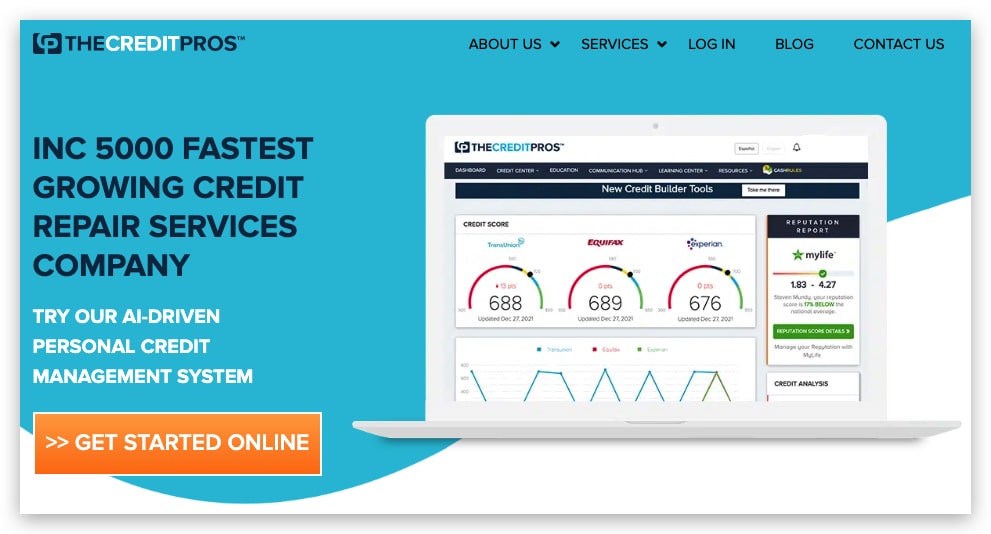

But if you’re one of the millions of Americans with a low credit score, there’s a solution out there, and it’s called TheCreditPros, one of the fastest-growing credit repair companies in the US that use AI to help you manage and optimize your credit score.

Before we dive into how TheCreditPros can help you repair and improve your credit score, let’s look at how your credit score impacts your finances.

How is Your Credit Score Calculated?

Your credit score is calculated by analyzing several factors related to your credit history.

While the exact formulas used by credit scoring companies may vary slightly, the most commonly used model is the FICO Score, developed by the Fair Isaac Corporation.

Here are the key components considered in calculating your credit score:

Payment History (35%): Your payment history is the most significant factor in determining your credit score.

It assesses whether you have made your timely payments, including credit cards, loans, mortgages, and other debts.

Late payments, defaults, or accounts in collections can have a negative impact on your score.

Credit Utilization (30%): This factor evaluates the amount of credit you are currently using compared to your total available credit limit. It is calculated by dividing your credit card balances by your credit limits.

Keeping your credit utilization ratio low (typically below 30%) is important for maintaining a good credit score.

Length of Credit History (15%): This factor considers the age of your credit accounts, including the age of your oldest and newest accounts, as well as the average age of all your accounts.

A longer credit history tends to have a positive impact on your credit score, as it provides a more comprehensive picture of your financial behavior.

Credit Mix (10%): The credit mix component assesses the types of credit you have, such as credit cards, mortgages, auto loans, and student loans.

Having a diverse mix of credit accounts can indicate responsible credit management and can positively impact your score.

New Credit (10%): This factor takes into account your recent credit inquiries and new credit accounts.

Opening multiple new accounts within a short period or having numerous credit inquiries can potentially lower your credit score.

It’s important to note that while these components are generally used in credit scoring models, their exact weightings and calculations may differ.

Additionally, other factors, such as public records (bankruptcies, liens, etc.) and the total amount of debt you owe, may also influence your credit score.

What’s a Good Credit Score?

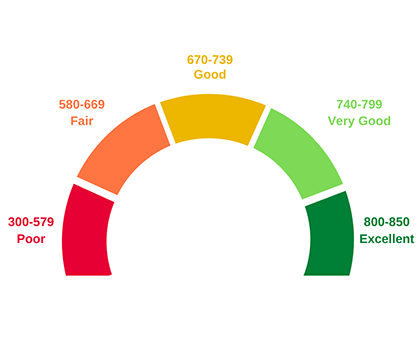

Credit scores typically fall within different brackets that indicate the level of creditworthiness of an individual.

While the specific ranges may vary depending on the credit scoring model used, here is a general breakdown of the common credit score brackets:

Poor or Bad Credit (300-579): Individuals in this range may have a history of late payments, defaults, or bankruptcies.

They may find it challenging to obtain credit or loans, and if approved, may face higher interest rates and less favorable terms.

Fair Credit (580-669): This range indicates some credit issues, such as missed payments or high credit utilization.

While individuals in this range may qualify for credit, they may still face higher interest rates and limited options.

Good Credit (670-739): Individuals in this range have a relatively solid credit history with responsible payment patterns.

They are likely to be approved for credit and loans with moderate interest rates and favorable terms.

Very Good Credit (740-799): This range reflects a strong credit history with a low risk of default.

Individuals in this bracket are usually offered competitive interest rates and favorable terms on credit and loan applications.

Excellent Credit (800-850): This is the highest credit score range, indicating a long and impeccable credit history.

Individuals in this bracket are considered highly creditworthy and often receive the most favorable interest rates and terms on credit and loan products.

It’s important to note that different lenders and institutions may have their own criteria and interpretation of credit score ranges.

While the brackets mentioned above provide a general guideline, the specific impact on loan approvals and interest rates may vary depending on the lender’s policies and individual circumstances.

Although my credit score is not bad, I wanted to improve it, so I decided to explore TheCreditPros.com, and share my experience through this in-depth product review.

How TheCreditPros Can help

TheCreditPros.com, a reputable credit repair company, offer a comprehensive range of services and a proven track record of empowering individuals to take control of their credit and unlock greater financial opportunities.

Easy and User-Friendly Process: Right from the start, I was impressed with TheCreditPros.com’s user-friendly website and intuitive sign-up process.

The website provides clear navigation and transparent information about their services, pricing, and testimonials.

The registration process was straightforward, requiring only basic personal information and details about my credit history.

Customized Credit Repair Solutions: One of the standout features of TheCreditPros.com is their commitment to tailoring their services to individual needs.

After signing up, I was assigned a dedicated credit repair specialist who thoroughly assessed my credit report and identified areas that needed improvement.

They formulated a personalized credit repair strategy to address inaccuracies, errors, and negative items on my report.

Expert Credit Analysis and Dispute Process: TheCreditPros.com’s team of highly skilled credit analysts delved into the intricacies of my credit history.

They performed a meticulous examination, identifying potential errors, inaccuracies, and outdated information that were negatively impacting my credit score.

The analysts then initiated a well-structured dispute process with the credit bureaus and creditors to rectify these issues promptly.

Transparent Progress Tracking: To keep me informed and engaged throughout the credit repair journey, TheCreditPros.com provided a user-friendly client portal.

This portal offered a transparent view of the progress being made, displaying updated credit scores and detailed reports on disputes and their outcomes.

The ability to track the progress in real-time instilled a sense of confidence and reassurance.

Exceptional Customer Service: Throughout my experience with TheCreditPros.com, I found their customer service to be exceptional.

Their credit repair specialists were knowledgeable, responsive, and always ready to address any queries or concerns I had.

They provided regular updates on the status of my credit repair and offered valuable advice on how to maintain and improve my credit score in the long run.

Educational Resources and Financial Guidance: TheCreditPros.com goes beyond credit repair by providing a wealth of educational resources and financial guidance.

Their blog and resource section offered insightful articles, tips, and strategies for managing personal finances, building credit, and making smart financial decisions.

This comprehensive approach aims to empower individuals with the knowledge necessary to achieve lasting financial success.

Ethical and Transparent Pricing: TheCreditPros.com follows an ethical and transparent pricing structure.

Their fees are based on the complexity of the credit repair process, ensuring that you only pay for the services you require.

During the sign-up process, they provided a clear breakdown of the costs involved, leaving no room for hidden charges or surprises.

Final Thoughts

Having partnered with TheCreditPros.com for my credit repair journey, I can confidently recommend their services to anyone seeking professional and reliable credit repair assistance.

Their user-friendly interface, personalized approach, expert analysis, transparent progress tracking, exceptional customer service, and commitment to financial education make them a standout credit repair company.

TheCreditPros.com equips individuals with the tools and knowledge they need to rebuild their credit and embark on a path towards financial freedom.

Regularly monitoring your credit report, ensuring on-time payments, maintaining a low credit utilization ratio, and responsibly managing credit accounts are key strategies to improve and maintain a good credit score.

DISCLAIMER: This post may contain affiliate links to products and services, for more information please review our Affiliate Disclaimer page.

0 Comments