Attention golf fans! If you love golf, I have great news for you, golf can actually help you become a better investor!

How? While golf and investing seem like completely opposite activities, they actually share many similarities.

If you can improve at one, most likely you can improve at the other one as well.

Let’s explore how playing golf can make you an even better investor.

What skills can golf teach us?

Golf, like any other sport, can teach us a lot of skills that can help us improve in any aspect of our lives.

Whether you’re looking to improve in your personal life or at work, golf is the type of sport that relies on strategy, skill, problem-solving, mindfulness, and many other valuable life skills.

Here are 10 valuable skills that golf can teach you and can help you become a better investor.

Golf teaches maturity

To be an effective golf player, you have to have a certain level of maturity, so you can think clearly and strategize how to beat others on the course.

Golf forces you to dig deep inside when you were hoping for a birdie, and instead ended up with a double bogey.

The more you try to force it, the harder it is to shake off your negative emotions so you can think rationally and clearly.

If you don’t, it clearly reflects in your performance, whether on the golf course, at work, or at home.

The same goes for investing, whether you’re a day trader or a long-term value investor, market swings, and intra-day movements can ruin a great investment if you let your emotions get in the way.

You need to be mature enough to accept that you can’t control all the variables of the game, and you need to have the patience (if you’re a long-term value investor) to ignore the noise and focus on the long-term strategy.

Golf teaches you how to be patience

Golf is a sport that requires a lot of patience, it takes time and continuous effort to become a good golf player, and even longer to become a great golf player.

If you want to be a great investor, you need to give yourself time to learn, make a few mistakes, and learn from them.

You need to give yourself time to develop the skills you need to compete in the investment game and have a fair chance to win.

Golf teaches problem-solving

In golf, you need to be constantly adjusting to new variables.

Things like sand, trees, and deep rough can all affect the course and the trajectory of your shot.

A common technique used by pro golfers is to visualize the end result of a shot, similar to how you should visualize the performance of your trades.

If the company has strong fundamentals and is on a good trajectory, don’t let the noise in the market ruin your trade.

Unless the core of the company changes, nothing else should influence your decision as long as you’re comfortable with the trade.

Golf requires expert instructions

Even the best golfers have a coach. Take for example Butch Harmon, one of the many coaches that Tiger Woods has had, even as a pro.

Under his leadership, Tiger Woods won his first 8 majors, which helped him become a legend and a major influencer in the golf world.

As an investor, you can either spend years learning on your own and have a disadvantage over the other investors in the market or invest money to learn from industry leaders.

Reading the amazing articles over at Seeking Alpha will help you get started, but is not going to be enough to make you a great investor.

Invest in books, courses, mentorship programs, access to the best in the industry, etc.

You want to shorten your learning curve as much as possible.

The quicker you master the fundamentals and understand each of your investments, the quicker you will generate the results you want from your investments.

Golf teaches you how to control your thoughts

To be a good golf player or successful in anything you do, you need to learn how to control your thoughts and steer clear from emotions.

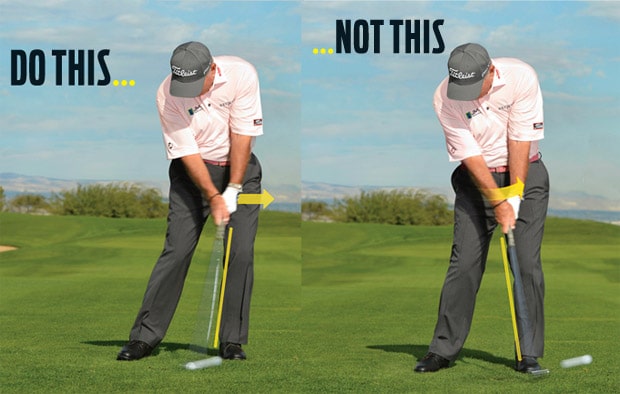

Emotions can force you to make poor decisions, you either hit the ball too hard or at the wrong angle because your emotions are in the way.

As an investor, is hard to steer clear of your emotions, especially when a lot of money is in the line, but you have to work at it to become a better investor.

Nearly all investors have made at least 1 terrible financial decision due to emotion, but it doesn’t have to be you.

Even if you let your emotions get in the way, that’s ok, you’re not a robot, you’re a human being, so just let it go!

If you learn how to control your emotions over time, you can reduce the risk of making a bad investment.

Sophisticated tools are not enough

Regardless of what fancy tool you use in golf or not, most likely it won’t be enough to help you dominate the game.

You need to dedicate a lot of time to the game in order to improve your swing and your overall performance.

The same goes for investing, no matter how sophisticated a piece of software might be or how the charts might look, it doesn’t compare with hard work and dedication to really understand the fundamentals and the art of each trade.

You need to read, you need to understand the industry, the company you’re investing in, what the market is saying, the performance of the company, and THEN, you still have to make a gut decision, but it will be an informed gut decision.

Short-term results are not an indicator of long-term results

One great shot doesn’t mean you’re suddenly a great golfer. One horrible game doesn’t suddenly mean that you’re a horrible golfer.

A common misconception in investing is that if a stock has gone up 10-fold in the last several years it could continue to go up even higher.

This unfortunately is not always the case, at least not in every industry you can invest in.

In fact, a market drop is a perfect opportunity to snatch up some good deals in companies that still have strong fundamentals and are poised to rebound in the near future.

Golf is about risk management

The best golfers are great at hitting the ball, staying cool, and managing risk on the course.

It’s not always easy to decide whether to lay-up or to go for the flag.

The same goes for investing, there are risks in every decision, every position held, every transaction.

What matters is that you understand that there will always be risks, and the name of the game is to hedge those risks as much as possible, to reduce the risk exposure with every underlying investment.

Everyone always has golf tips

Every golfer has had a friend, stranger, or playing companion provide advice on his swing.

Unfortunately, some of that advice can actually work against you, it could be detrimental to your golf game.

The same goes for investing, everyone thinks they found the loophole to maximize their investments.

I can’t tell you how many people are always telling me to invest in marijuana because that’s the next big boom, or to invest in solar energy because the oil will eventually run out.

Bottom line, if you’re going to act on any investment advice you receive, be sure to take your time and review it well to make sure it fits your financial goals.

Or better yet, consult with your financial advisor or an expert that can guide you.

Golf teaches you to look and plan ahead

If you don’t know where you’re going, how will you end up in a good place?

Each shot on the golf course requires a target. That target is chosen based on the obstacles and the location of the hole.

Your investment strategy must also have a target. Do you want to invest for when you retire? Do you want to take on more risk in order to maximize your ROI potential?

You need to clearly define your goals so you can work backward and determine what needs to happen to get there.

Closing Thoughts

And there you have it, 10 simple similarities between golf and investing.

Planning, patience, and expert instructions are great ways to improve your golf game and your investment strategy.

Based on your experience, what golf lessons have you learned that can be applied to investing?

Please share in the comments below.

DISCLAIMER: This post may contain affiliate links to products and services, for more information please review our Affiliate Disclaimer page.

0 Comments